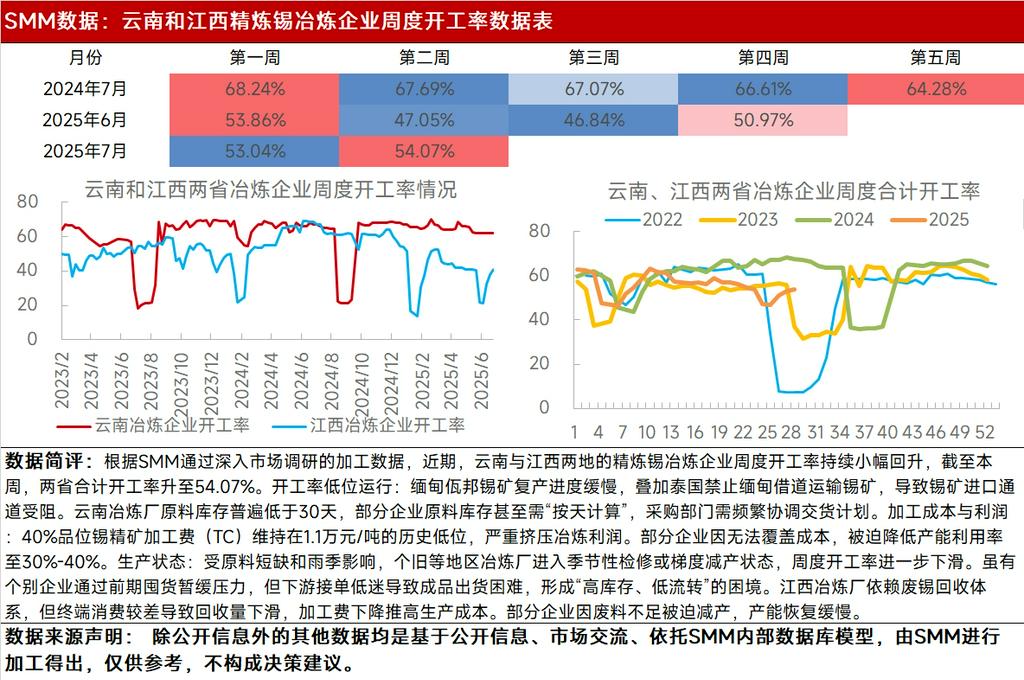

According to the processing data from SMM's in-depth market survey, the weekly operating rates of refined tin smelters in Yunnan and Jiangxi have continued to rebound slightly in recent times. As of this week, the combined operating rate of the two provinces has risen to 54.07%. Low operating rates: The slow progress of tin ore production resumptions in Myanmar's Wa region, coupled with Thailand's ban on Myanmar's use of its territory for tin ore transportation, has blocked the import channels for tin ore. The raw material inventory of Yunnan smelters is generally below 30 days, with some enterprises even needing to calculate their inventory "day by day," requiring frequent coordination of delivery plans by the purchasing department. Processing costs and profits: The treatment charges (TCs) for 40% grade tin concentrates have remained at a historical low of 11,000 yuan/mt, severely squeezing smelting profits. Some enterprises have been forced to reduce their capacity utilization rates to 30%-40% as they cannot cover their costs. Production status: Affected by the shortage of raw materials and the rainy season, smelters in areas such as Gejiu have entered seasonal maintenance or gradient production cuts, with weekly operating rates declining further. Although some enterprises have temporarily alleviated pressure through stockpiling in the early stage, the sluggish demand for orders from downstream has led to difficulties in selling finished products, resulting in a dilemma of "high inventory and low turnover." Jiangxi smelters rely on the scrap tin recycling system, but poor end-use consumption has led to a decline in recycling volume, and a drop in treatment charges has driven up production costs. Some enterprises have been forced to cut production due to insufficient scrap, and capacity recovery has been slow.

[SMM Analysis] Operating rates of smelters in Yunnan and Jiangxi provinces have rebounded slightly, while the overall raw material supply remains tight.

[SMM Analysis: Operating Rates of Smelters in Yunnan and Jiangxi Rebound Slightly, While Raw Material Supply Remains Tight] According to SMM's in-depth market survey and processing data, the weekly operating rates of refined tin smelters in Yunnan and Jiangxi have continued to rebound slightly in recent periods. As of this week, the combined operating rate of the two provinces has risen to 54.07%. Low operating rates: The resumption of tin ore production in Myanmar's Wa region has been slow, coupled with Thailand's ban on Myanmar's use of its territory for tin ore transportation, which has blocked tin ore import channels. The raw material inventory of Yunnan smelters is generally below 30 days, with some enterprises even needing to "calculate inventory on a daily basis," requiring frequent coordination of delivery plans by the purchasing department. Processing costs and profits: The treatment charges (TCs) for 40% grade tin concentrates have remained at a historical low of 11,000 yuan/mt, severely squeezing smelting profits. Some enterprises have been forced to reduce their capacity utilization rates to 30%-40% due to their inability to cover costs. Production status: Affected by the shortage of raw materials and the rainy season, smelters in areas such as Gejiu have entered seasonal maintenance or gradient production cut states, with weekly operating rates declining further. Although some enterprises have temporarily alleviated pressure through stockpiling in the early stage, weak downstream order-taking has led to difficulties in finished product shipments, creating a dilemma of "high inventory and low turnover." Jiangxi smelters rely on a scrap tin recycling system, but poor end-use consumption has led to a decline in recycling volume, and a drop in treatment charges has driven up production costs. Some enterprises have been forced to cut production due to insufficient scrap materials, with capacity recovery being slow.

Data Source Statement: Except for publicly available information, all other data are processed by SMM based on publicly available information, market communication, and relying on SMM‘s internal database model. They are for reference only and do not constitute decision-making recommendations.

For any inquiries or to learn more information, please contact: lemonzhao@smm.cn

For more information on how to access our research reports, please contact:service.en@smm.cn

![The Most-Traded SHFE Tin Contract Opened Lower and Then Traded Stronger, Spot Market Recovers Amid Downtrend [SMM Tin Midday Review]](https://imgqn.smm.cn/usercenter/WWXJU20251217171753.jpg)

![The most-traded SHFE tin contract fluctuated rangebound during the night session, with downstream enterprises mostly following up with small-lot transactions. [SMM Tin Morning Brief]](https://imgqn.smm.cn/usercenter/bYFQn20251217171752.jpg)